About Us

Our firm offers a wide variety of investment

services and products to individual and institutional investors. Our

approach is to review and evaluate all investment asset classes and

apply them to develop robust custom portfolios for our

clients. The goal is to assist our clients in achieving their financial

objectives in the most risk adjusted way possible. Our commitment

is to use all asset classes appropriate for a specific client portfolio

to achieve these objectives.

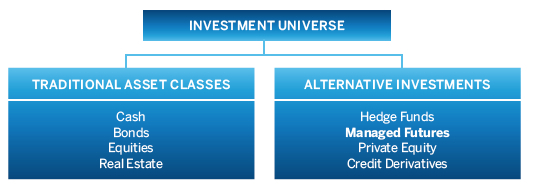

The majority of investment firms focus on the stock market, and to a lesser degree the bond market, to meet these goals. Stocks and bonds, with their managed vehicle of mutual funds, have helped investors meet their retirement needs for some time, and are an important part of any income or growth portfolio. As an investment advisor representative (IAR), our principal David Johnson uses the traditional tools of the trade to construct stock, bond, mutual fund, and ETF portfolios. To learn more refer to the Portfolio Solutions page.

In

addition to these traditional asset

classes, Global Capital Group offers a variety of alternative

investments to complement portfolios. These include the evaluation and

access to investments that use asset classes other than stocks as

investment vehicles. This large and diverse category of alternative

investments includes Private Equity, Managed Futures, Hedge Funds, and

Real Estate Private Placements. Global Capital Group is a member

of the National

Futures Association (NFA), registered with the Commodity Futures Trading

Commission (CFTC) and guaranteed by ADM

Investor Services Inc.

In

addition to these traditional asset

classes, Global Capital Group offers a variety of alternative

investments to complement portfolios. These include the evaluation and

access to investments that use asset classes other than stocks as

investment vehicles. This large and diverse category of alternative

investments includes Private Equity, Managed Futures, Hedge Funds, and

Real Estate Private Placements. Global Capital Group is a member

of the National

Futures Association (NFA), registered with the Commodity Futures Trading

Commission (CFTC) and guaranteed by ADM

Investor Services Inc.

Global Capital Group, clearing through ADM Investor Services Inc. provides our clients access to many professionally managed alternative investments in the managed futures asset class. The managed futures programs are similar to mutual funds, providing regulated professional management, diverse strategies, and visibility. The difference is that this asset class uses the global futures markets to take positions in real assets, which often move in an uncorrelated fashion to the stock market. This non-correlation is an important underpinning of Modern Portfolio Theory with its goal to reach the Efficient Investment Frontier with the highest return and the lowest risk.

Our experience coupled with good industry relationships allows us to offer these comprehensive investment portfolios that span traditional and alternative asset classes. These non-correlated, diverse portfolios of stocks, bonds, mutual funds, managed futures programs, private placements and other investments provide our clients with ample diversification. Our goal is to reduce portfolio risk while achieving our clients' financial objectives.

We invite you to give us a call to determine if we may be of service to you.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE

RESULTS. INVESTORS MUST READ THE CURRENT DISCLOSURE DOCUMENT OF

THE RESPECTIVE PROGRAM BEFORE THEY INVEST. FUTURES AND OPTIONS

TRADING INVOLVES SUBSTANTIAL RISK OF LOSS NO MATTER WHO IS MANAGING

YOUR MONEY. AN INVESTOR COULD LOSE MORE THAN THE ORIGINAL

INVESTMENT. THERE IS UNLIMITED RISK OF LOSS IN SELLING

OPTIONS. A COMPLETE DISCUSSION OF FEES AND CHARGES ARE REPORTED

IN THE CTA’S DISCLOSURE DOCUMENT.